Trade With Capital.

Grow With Support.

Grow With Support.

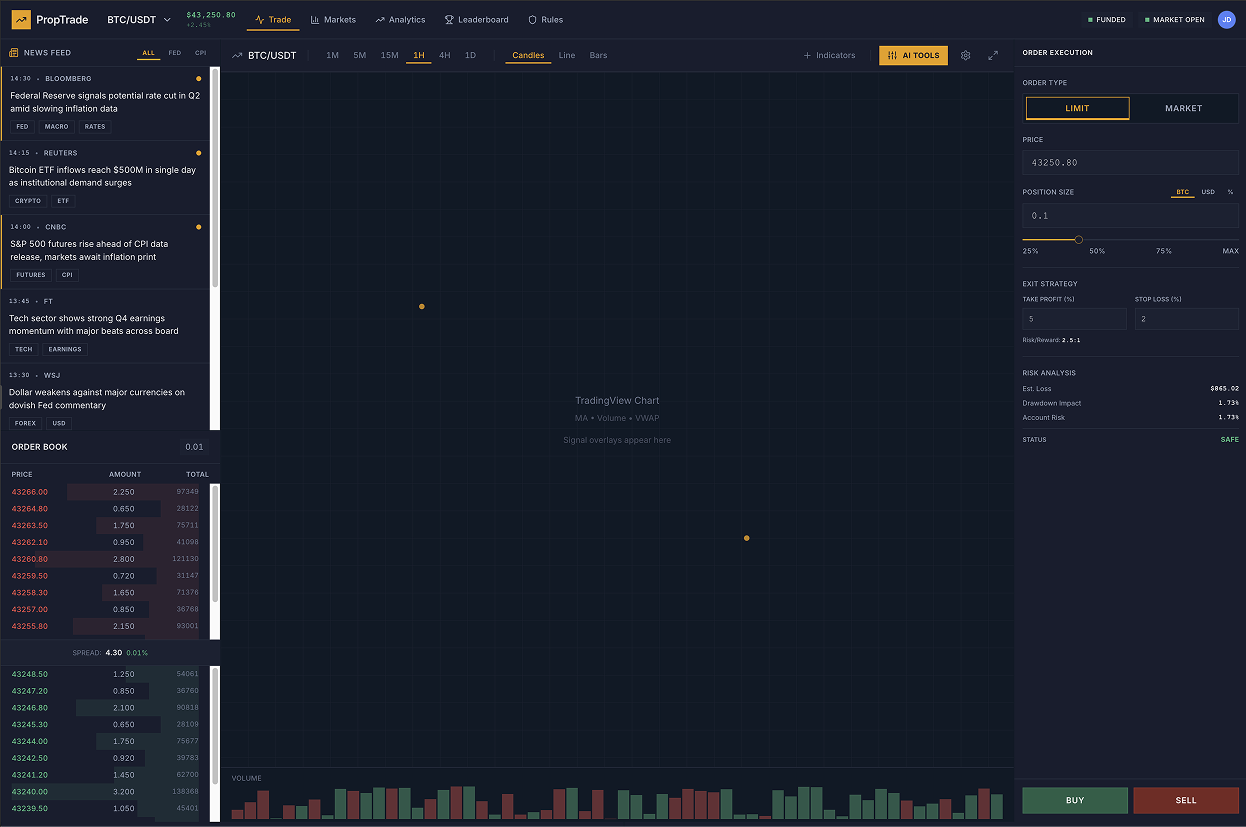

A professional trading environment where execution, risk control, market context, and performance analytics operate as a single system.

- One systemUnified execution, risk, context, and analytics

- Risk-FirstEvery order is risk-checked before execution

- Full ContextNews and analytics inside the terminal

- Built to ScaleFrom challenge to funded capital access

One terminal.

Total control.

A unified workspace where execution, risk control, market data, and analytics operate as a single system.

Proprietary terminal, not third-party platform access

Unified execution core across all markets

Built for clarity, speed, and extended sessions

Everything in one workspace — no external tools required

1

Trade protected with Real-Time Risk Control

Risk is validated before every execution — not reviewed after. Drawdown limits, position sizing, and exposure rules are enforced by the system as code, not as policies on a website.

2

Track your progress with Built-In Analytics

Track your discipline, risk-adjusted returns, and execution quality without external dashboards

- Trade-Level InsightsDetailed breakdown of every trade with entry, exit, risk data

- Risk-Adjusted MetricsConsistency scoring and performance evaluation

- Pattern RecognitionBehavioral analysis tracking discipline, timing

- Integrated DashboardAll performance data accessible inside the terminal

3

Build discipline with AI Guidance

The AI system supports discipline through real-time alerts, risk warnings, and structured training scenarios

- Custom AlertsPattern and indicator alerts configured based on your trading rules

- Risk WarningsProactive notifications before you approach drawdown or exposure limits

- AI Training ScenariosPractice decision-making in market replays without access to future data

- Behavioral FeedbackPost-trade analysis highlighting patterns, mistakes

4

Prove consistency with Live Rankings

Every challenge account automatically participates in performance-based rankings. Competition is based on consistency, risk discipline, and execution quality — not short-term outcomes. Top performers earn rewards, account upgrades, and faster scaling opportunities.

5

Stay connected to your trading state with alerts

Risk warnings delivered via Telegram, WhatsApp, or Discord in real time

Core philosophy

The platform is designed for trader development. The system is built to support long-term consistency, disciplined decision-making, and controlled risk behavior.

Trading is treated as a professional skill — not a sequence of isolated outcomes.

- We measure disciplinePerformance is evaluated through risk behavior, consistency, and execution quality — not lucky trades.

- We build repeatable processThe platform reinforces structured decision-making through feedback, context, and enforceable rules.

- We grow long-term tradersThe goal is sustainable performance over time, with progression paths that reward consistency.

Structured Challenge.

Real Progression.

Challenge Account

Trade in a simulated environment under real rules and professional risk constraints. The challenge mirrors live market conditions — not simplified practice modes.

- Predefined drawdown limits

- Position sizing and exposure controls

- Same infrastructure as funded accounts

Prove your strategy

Simulated environment

Evaluation Phase

Performance is assessed through behavior, not outcomes. The system tracks trade execution, risk management, and how reliably you follow the framework over time.

- Risk discipline across multiple sessions

- Pattern reliability metrics

- Rule adherence and decision quality

Performance-based assessment

Simulated environment

Funded Account

Traders who demonstrate disciplined, repeatable performance gain access to firm capital with profit-sharing and long-term growth opportunities.

- Real capital allocation

- Profit split model

- Scaling based on proven discipline

Real capital

Hybrid model with profit sharing

Choose Your Challenge Size

Each challenge provides access to the same professional trading infrastructure. The difference is the account size and corresponding risk limits.

- Up to 80% Profit SplitYour earnings from funded accounts. Performance-based, not capped by arbitrary limits

- 5% Daily / 10% Total DrawdownClear risk boundaries enforced by code before every trade — no surprises after the fact

- Account Scaling to $200K+Consistent traders unlock larger capital allocations over time. Discipline = growth

- Bi-Weekly PayoutsRequest withdrawals every 14 days once consistency requirements are met

- Multiple Access TypesAvailable for retail traders, coaching programs, and algorithmic strategies

Most Popular

Account Size $25,000Ideal for new traders

One-time fee $149

Account Size $50,000Best for experienced traders

One-time fee $249

Account Size $100,000For serious professionals

One-time fee $349

Max Daily Drawdown

None

None

None

Max Total Drawdown

$1,000 (4%)

$2,000 (4%)

$4,000 (4%)

Profit Target

$2,500 (10%)

$5,000 (10%)

$10,000 (10%)

Minimum Trading Days

None

None

None

Allowed Markets

Futures

Futures

Futures

Max Position Size

3 contracts

5 contracts

10 contracts

News Trading

Allowed

Allowed

Allowed

Weekend Holding

Not Allowed

Not Allowed

Not Allowed

Scaling Eligibility

After 90 days

After 90 days

After 90 days

- Up to 80% Profit SplitYour earnings from funded accounts. Performance-based, not capped by arbitrary limits

- 5% Daily / 10% Total DrawdownClear risk boundaries enforced by code before every trade — no surprises after the fact

- Account Scaling to $200K+Consistent traders unlock larger capital allocations over time. Discipline = growth

- Bi-Weekly PayoutsRequest withdrawals every 14 days once consistency requirements are met

- Multiple Access TypesAvailable for retail traders, coaching programs, and algorithmic strategies